Hi ajuma fam! If you’re new, welcome. ajuma is a nonprofit that prepares Black & Latinx undergrads for business careers in tech. Our monthly newsletter gives updates on our work, offers ways to get involved, and provides our perspective on an equitable and inclusive future of work. This month, we’re doing a DEI post-mortem: what happened?

ajuma updates

Our first Bridge series video featuring Issac Vaughn is now available on our website and YouTube

Our second aspire cohort kicks off on March 27th. Know any students who might be interested? Send them here.

We are launching the first ajuma course: “the business of tech” on March 20th

What we’re bumping

Newly minted Grammy winner Victoria Monet’s We Might Even Be Falling in Love

How you can help

Introduce us to a friend or colleague in tech for aspire

Share the aspire application with a Black or Latinx student you know

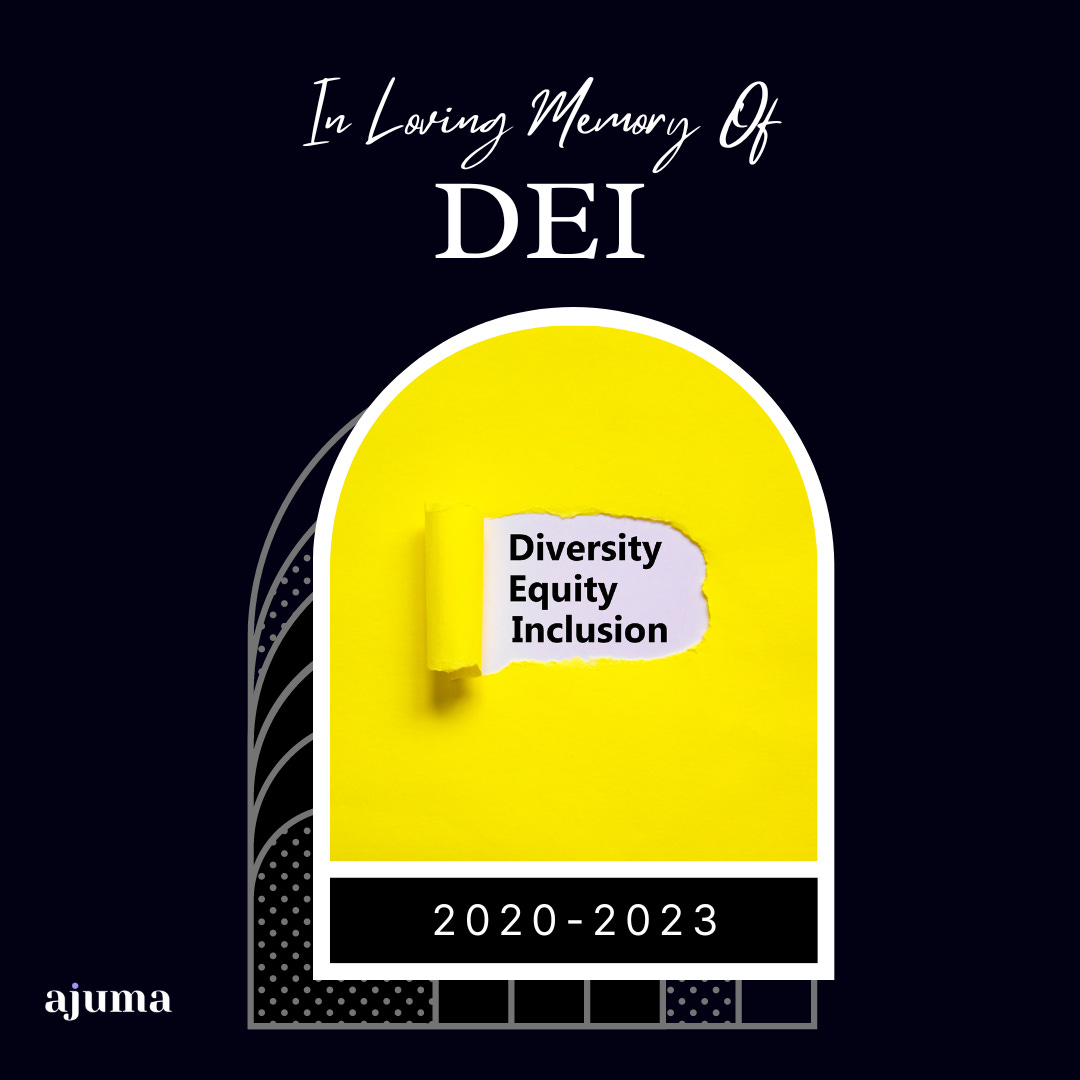

DEI is “dead”

Last year, corporate DEI mentions dropped to their lowest level since 2018. Yet just four years ago, DEI was a corporate priority for 96% of fortune 500 CEOs. What happened?

It’s important to note that for decades, corporate leaders and their shareholders have been primarily focused on generating shareholder value, with diversifying their workforces low on the agenda. From their perspectives, it was an added expense that was not proven to generate enough shareholder value to justify the investment.

Investing in DEI requires not only hiring people to specifically focus on this aspect of the business, it requires reimagining large parts of how the business operates, communicates, and evaluates its people. This takes years, not months, and by the end it won’t be possible to determine financially whether all that change was actually worth it. This helps to explain why the majority of Fortune 500 companies made little concrete investments in DEI efforts, at least until 2020.

In June of 2020, George Floyd was killed by a police officer in a video that went viral around the world. Although extrajudicial police executions of Black men are not new, this particular murder seemed to cause a tidal wave of change in attitudes towards anti-racism efforts. Companies that previously criticized organizations like #BlackLivesMatter suddenly embraced them. Within a year, Fortune 50 companies had pledged over $50 billion to address racial inequity. By 2022, every Fortune 100 company had made a public pledge to commit to diversity, equity, and inclusion.

Four years later, DEI seems to be on the chopping block. After rising 30% from 2020 - 2021, DEI job postings fell 20% in 2022, then fell another 44% in 2023. Prominent tech companies like Meta, Amazon, and Google have cut back on their DEI investments. Loud voices in the industry like Elon Musk are leading a conservative backlash against the space, calling it “immoral.” This backlash is emboldened by legal precedent, as the revoking of affirmative action last year enables its opponents to label efforts to distribute opportunities or capital to diverse groups as illegally discriminatory.

However this public discourse obscures a more encouraging reality. HR professionals report that existing DEI programs are relatively safe, with 69% reporting that DEI funding increased from 2022 to 2023. Less than 10% of HR leaders at companies with a DEI budget say that budget was reduced in 2023. This seems to be mainly driven by the lack of an economic downturn, since only 30% strongly agree that their company will not sacrifice DEI in tough times. What this reveals is a DEI complex that is growing much slower than it was post-pandemic, at risk of collapsing during the next recession. Although the recession risk is alarming, the anti-DEI narrative is more of a culture war than an existing reality.

This culture war is being fought by sides that seem to have little understanding of each other. One side seems to have little understanding of the indisputable systemic racism and patriarchy that, to the other side, necessitates these sorts of diversity programs. And the other side seems to have little understanding of the purely capitalist focus of their opponent’s perspective - why should companies have to “discriminate” in their hiring when that has clear costs and intangible benefits? In fact, investments in diversity have never been proven to produce financial returns. At best, we are able to show correlation but not causation.

It makes rational sense that investing in diverse teams increases the company’s chances of success due to the wide array of experiences and perspectives that people with diverse backgrounds bring to the table. But we will struggle to ever communicate that ROI in as compelling a way as a performance marketer can justify an ad spend.

Business leaders must reject the notion that maximizing shareholder returns is paramount; instead they must embrace a broader vision of success that encompasses learning, innovation, creativity, flexibility, equity, and human dignity…leaders must acknowledge that increasing demographic diversity does not, by itself, increase effectiveness; what matters is how an organization harnesses diversity, and whether it’s willing to reshape its power structure.

- Harvard Business Review 2020

The business case for diversity is simply not compelling. And it’s not what motivated the recent surge of diversity investments in the first place. DEI did not surge in funding and popularity in 2020 because it suddenly became more profitable. DEI surged in popularity in 2020 because the “why” behind it finally resonated with millions of people. For those who came on board the DEI train that year, they joined because it felt like the right thing to do. Corporate leaders should invest in DEI not for financial reasons, but for moral ones. Because allowing all of us to participate in creating our future makes us all better in ways both measurable and immeasurable.

DEI is not dead. Profit-driven inclusion is. Leading with empathy over greed, we can co-create inclusive environments for each other without distilling our humanity to a line item on a balance sheet.